Core Products

What are the Core Loan Programs most commonly used to fund loans through ICS?

01

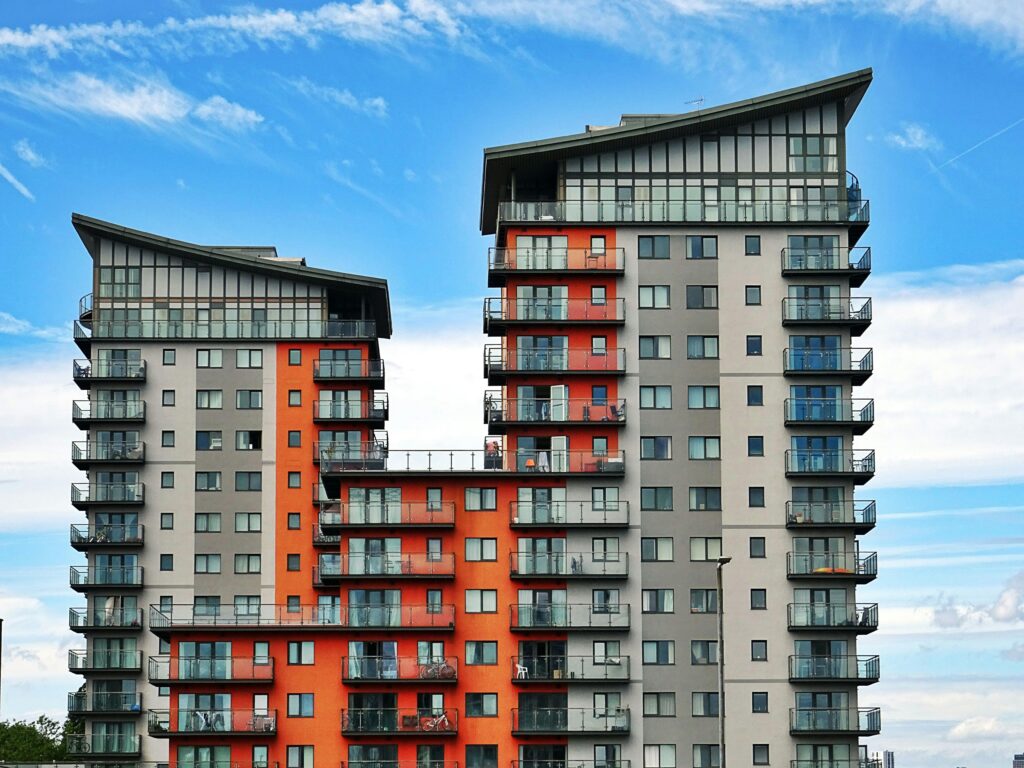

Short-Term Bridge Loans

Multifamily, Investment, and Commercial Bridge Loans provide competitive rates for borrowers in need of short-term financing for 12 to 36 months.

02

Long-Term Permanent Loans

Commercial, multifamily, and investment property. Permanent Loans provide competitive rates for stabilized buildings and borrowers in need of permanent longer-term financing.

03

Ground-Up & Rehab Construction Financing

Multifamily, office, retail, industrial, mixed-use, specialty use, 1-4 unit residential. Loan is fixed or variable for up to 3-years with interest only amortization.

Take the First Step Toward Smarter Real Estate Financing